Content

Another way of accounting for your rental income is the “accrual method,” which means you report your income when it’s earned and not when it’s received. Appfolio requires a $400 onboarding fee, in addition to a monthly per-unit fee that ranges from one type of property to another. Since the minimum monthly fee is $250, Appfolio is best suited for property managers with at least 50 units. While Appfolio is more expensive than other property management platforms, it is one of the best platforms for landlords who work with large commercial properties and have to manage large portfolios. This versatile software works for many types of properties such as commercial, residential, and mixed-use buildings. One of the biggest perks of Yardi Breeze is that it offers excellent customer service and free training.

Keeping detailed and accurate accounts is vital when managing properties. There are several critical components to rental property accounting, and banking is certainly one. Here are a few quick tips to help you better conceptualize how your banking framework should be set up as you grow and scale your real estate investing business. Before getting started, it’s helpful to understand bookkeeping and accounting functions and how they are related to one another. Bookkeeping is the recording of financial transactions for individuals or businesses.

Here are some of the steps for setting up your accounting:

That means you can manage the entirety of your rental business in one platform, with one login — for free. Rental income consists of rent payments, late rent fees, pet fees, termination fees, and appliance rental fees. Just as there are many different types of rental income, there are also many different types of expenses. Some of these expenses include repairs, routine maintenance, landscaping, utilities, marketing tools, property management fees, attorney fees, accountant fees, mortgage, property tax, and insurance.

- When personal and property expenses become merged, this is referred to as “commingling funds” and is a big no-no in the tax world.

- Mortgages and deeds should be maintained this way indefinitely, and bank statements and other important documents should be kept on paper for at least three years.

- Set up rules to automatically tag transactions by category and assign them to properties.

- Most programs will list expenses one side and income on the other with a checkbox next to every transaction.

- Tracking expenses for your rental properties is important because it helps you ensure that your rental properties are a lucrative investment.

And have the power to review, edit, and print ledgers for every property, tenant, owner, and bank account used to manage your properties. Traditional accounting systems are not designed for property management and require double or even triple entry of transactions to maintain accurate and auditable records. Properly handling your rental income and expenses, including accurately accounting for and tracking your funds, is an essential part of rental management. At Harrisburg Property Management Group, we offer accounting and rent collection assistance in Hershey, Harrisburg, Mechanicsburg and beyond as a part of our comprehensive suite of services. These complete management services help you make the most of your property ownership experience, freeing you up to focus on other things and to sit back and enjoy your returns.

Get started with Landlord Studio now.

One of the most important goals you’re trying to accomplish here is separating your business finances from your personal finances. It makes it easier to track how your business is performing, it’ll make you more organized come tax time, and it will keep you from making a costly mistake that leads to an IRS audit. Property managers often handle bookkeeping in addition to other tasks, such as filling vacancies, collecting rent, and managing maintenance requests.

What type of account is best for rental property?

Rental property owners should always have separate personal and business accounts. Having a business bank account makes it easier to track income and expenses. You want to be able to know in an instant how much of your money is set aside for business and how much can be spent on personal expenditures.

They’ll know how to use different depreciation schedules and can make sure you’re not overlooking deductions that can decrease your tax bill. That amount is deducted from the security deposit, credited as income received, then expensed to pay for the carpet damage. Investing in rental property can be a great way to generate passive, recurring income and build wealth over the long term.

What expenses must be capitalized for rental property?

Once a late notice is issued, we monitor the situation to see if we get a response. The team at Harrisburg Property Management Group will recommend the next steps such as taking legal action when absolutely needed. Our professionals have the ability to send electronic invoices and alerts that make it simple to receive your money when it is due. We use online payment tools that make it easy for payments to transfer directly to your bank.

- RentRedi’s accounting integration with REI Hub is the easy way to keep accurate books for your rental properties in 2023.

- Supporting documents provide evidence in the event of a tax audit by the IRS that the expenses you claimed for your business are valid.

- By comparing the expected rent payments to the actual payments received, the report is able to identify any discrepancies and ensure that all rent payments have been received and accounted for correctly.

- Over time, your historical financial data will help you forecast these costs with greater accuracy.

- Furthermore, income might be inconsistent if the building isn’t managed properly.

Furthermore, income might be inconsistent if the building isn’t managed properly. It’s also important to ensure something is an operating expense before categorizing it as such. Lastly, a professional accountant is a reliable source you can go to with questions and issues. Being a landlord can be stressful, so having an expert in your corner is valuable. It’s important to note that you cannot use the cash method if your business maintains inventory, is a corporation, or has gross receipts exceeding $26 million per year.

Which Property Tax Forms Do I Need to File?

It’s highly recommended that rental property businesses digitize such things as receipts with rental property accounting apps. Digitization declutters your office by organizing your receipts digitally and makes it much easier to access specific receipts during tax time or audits. We tailor rental property bookkeeping our services to help each client determine how to meet their landlord accounting needs. Say goodbye to crunching numbers, trying to organize and track expenses from different rental properties on your own, and hours spent researching your financial and tax obligations—we have you covered.

What account type is the rent expense account?

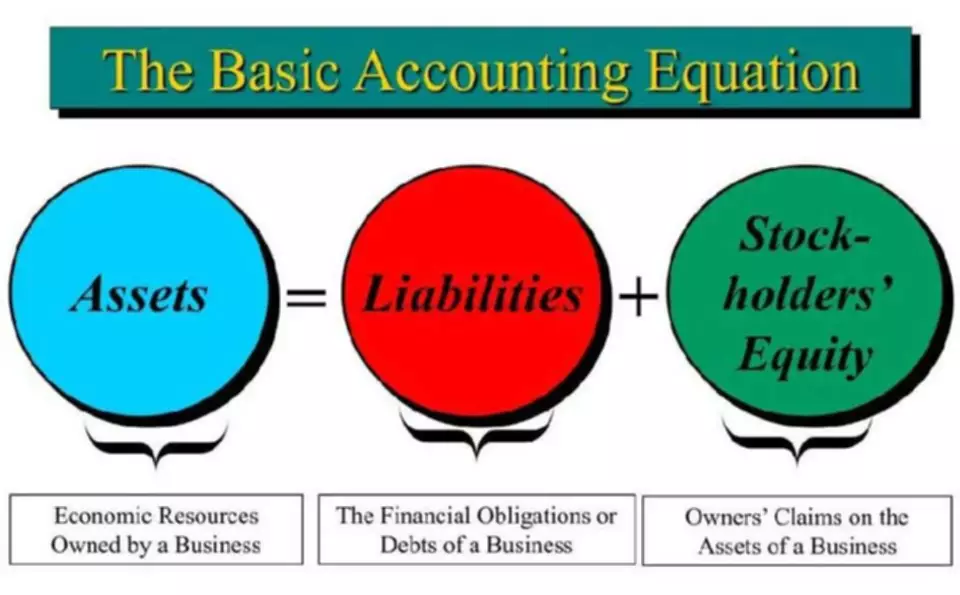

Rent account is a nominal account. Other examples of nominal accounts are wages account, commission account, interest received account. The rule for nominal accounts is: Debit all expenses and losses; Credit all incomes and gains.

You also need to understand the difference between improvements and repairs. The expense of property improvements has to be capitalized and depreciated over several years instead of deducted in the year paid. On the other hand, repairs are treated as maintenance expenses and deducted from the year’s income. It’s https://www.bookstime.com/articles/prepaid-expenses also an important factor when it comes to analyzing not only the income, but also the expenses on each property. This accounting system will serve as a guide on how to increase revenue and strategically reduce expenses. It will also serve as a timeline to make sure that all expenses are paid in a timely manner.

[Downloadable] Rental Property Expense Spreadsheet

You’ll have a better grasp of your property’s profitability and can fine-tune your property management to help increase cash flows and profits. If you’re holding your rental property in an LLC, the bank will require copies of your incorporation documents and your federal tax identification number. Even if you use an accountant or CPA to file your year-end tax returns, it’s still a good idea to know what the basic tax forms look like and what they’re used for. Having the right tools in place can help you manage finances for a rental property. A tax pro can help with everything from completing basic tax forms to calculating depreciation to accurately estimating future tax payments. If you’re updating your accounts on a regular basis with a software like Landlord Studio staying on top of the numbers shouldn’t be hard.